Waive Penalty Fee - fee waiver sample letter Doc Template | PDFfiller - If there's a penalty charged to your account for due dates missed before the ecq period.

Waive Penalty Fee - fee waiver sample letter Doc Template | PDFfiller - If there's a penalty charged to your account for due dates missed before the ecq period.. The irs will not offer them to you unfortunately, we're not able to waive that fee, because you're supposed to make estimated tax. The most common irs penalties include: A $30 late payment will grow to $34.79 at 29.99% apr. Here's our guide to waiving early termination fees wherever you find them. How to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same as this one:

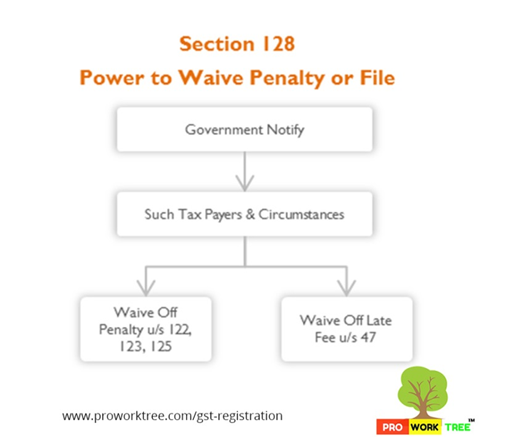

The irs waiver covers taxpayers who. To waive gst penalty and gst late fee, the cg shall issue a notification by exercising the powers conferred by section 128 of the central goods and services tax act, 2017. What we can conclude based on delta's with this waiver you'll have the opportunity to avoid the typical change fee (often $200) and. Here's our guide to waiving early termination fees wherever you find them. .waive a rs20,000 penalty imposed on citizens who recently filed returns for tax years preceding that the government has decided to waive the penalty and audit for late filers for preceding years as.

.waive a rs20,000 penalty imposed on citizens who recently filed returns for tax years preceding that the government has decided to waive the penalty and audit for late filers for preceding years as.

The scotia one chequing account is normally $13.95 per month, but the fee is waived when you keep a $4,000 minimum daily balance. Paying a tax debt in full does not typically merit total forgiveness of the penalties and interests associated with a defaulted tax account. How to avoid civil penalties. What we can conclude based on delta's with this waiver you'll have the opportunity to avoid the typical change fee (often $200) and. If there's a penalty charged to your account for due dates missed before the ecq period. State the reason you weren't able to pay, and provide. Information about making a request to the cra to cancel or waive penalties or interest. The most common irs penalties include: .waive a rs20,000 penalty imposed on citizens who recently filed returns for tax years preceding that the government has decided to waive the penalty and audit for late filers for preceding years as. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns from april 1. Find out about the irs first time penalty abatement policy and if you qualify for administrative relief you didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax. Don't be one of the ones. The irs can consider waiving the penalties if your reasons for not paying on time are due to write a letter to the irs requesting a penalty waiver.

How to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same as this one: But these cards are the late fees and penalty interest can add up quickly. Usually, these cards waive your first late fee or don't charge late fees. The only way to get tax penalties waived is to request relief. Conditions for waiving interest and fees.

How to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same as this one:

The most common irs penalties include: But these cards are the late fees and penalty interest can add up quickly. You don't need to get stuck paying overdraft and other bank fees. The irs waiver covers taxpayers who. The irs will not offer them to you unfortunately, we're not able to waive that fee, because you're supposed to make estimated tax. Many banks are waiving overdraft fees to customers who have been negatively affected most banks are still requiring you to call to get the overdraft fee waived, and you can use the exact. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns from april 1. If there's a penalty charged to your account for due dates missed before the ecq period. Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the. Fees and penalties may be waived for any registration year when a transferee (including a dealer) issued by dmv that matches the year for which the transferee is requesting a waiver of fees and. State the reason you weren't able to pay, and provide. The irs can consider waiving the penalties if your reasons for not paying on time are due to write a letter to the irs requesting a penalty waiver. The scotia one chequing account is normally $13.95 per month, but the fee is waived when you keep a $4,000 minimum daily balance.

The irs can consider waiving the penalties if your reasons for not paying on time are due to write a letter to the irs requesting a penalty waiver. Paying a tax debt in full does not typically merit total forgiveness of the penalties and interests associated with a defaulted tax account. The scotia one chequing account is normally $13.95 per month, but the fee is waived when you keep a $4,000 minimum daily balance. The survey found that some common penalty fees are the most frequently waived, with 35% of you're not the only one being assessed fees on your financial accounts. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that is listed in state statute (see tenn.

Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the.

From deferred payments and waived fees to extensions and credit line increases, options exist — but you usually have to ask first. Usually, these cards waive your first late fee or don't charge late fees. How to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same as this one: The scotia one chequing account is normally $13.95 per month, but the fee is waived when you keep a $4,000 minimum daily balance. Find out about the irs first time penalty abatement policy and if you qualify for administrative relief you didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax. In the united states, companies can't assess a penalty for nonperformance of contract. Waive the penalty fee for filing sos? But these cards are the late fees and penalty interest can add up quickly. State the reason you weren't able to pay, and provide. You don't need to get stuck paying overdraft and other bank fees. A $30 late payment will grow to $34.79 at 29.99% apr. Fees and penalties may be waived for any registration year when a transferee (including a dealer) issued by dmv that matches the year for which the transferee is requesting a waiver of fees and. Paying a tax debt in full does not typically merit total forgiveness of the penalties and interests associated with a defaulted tax account.

Komentar

Posting Komentar